A blueprint for Nature Regeneration Project Insurance Programmes

Nature regeneration projects are bold by design. They can promise thriving ecosystems, or measurable biodiversity gains, carbon outcomes, long-term social value, and combinations of these and more - all while aiming to be financially sustainable. But ambition comes with complexity. These projects weave together multiple stakeholders, shifting regulations, and evolving science, creating a web of risk that can leave developers and stakeholders exposed.

Right now, the natural capital insurance market is fragmented and immature. That means uncertainty, weaker investor confidence, and projects struggling to attain effective risk transfer. At GaiaSicura Ltd., we’re changing that. We design specialist insurance solutions that protect every element of a project — financial, legal, and physical — so outcomes aren’t just delivered, they’re safeguarded. By making regeneration insurable, investable, and resilient, we help turn nature projects into assets buyers trust, not liabilities they fear.

The following sets out a summary of a practical framework: how targeted insurance mechanisms can de‑risk projects, unlock finance, and guarantee lasting impact. Every project is unique, and coverage will always depend on its specifics — but with early engagement and tailored design, risk can be fully transferred, giving stakeholders the confidence to invest in nature’s future. We use the term “unit” herein to represent any offtake, whether BNG, Carbon, NFM, or other more esoteric measurable output, likewise “developer” can mean any entity with the ultimate responsibility of delivering the project.

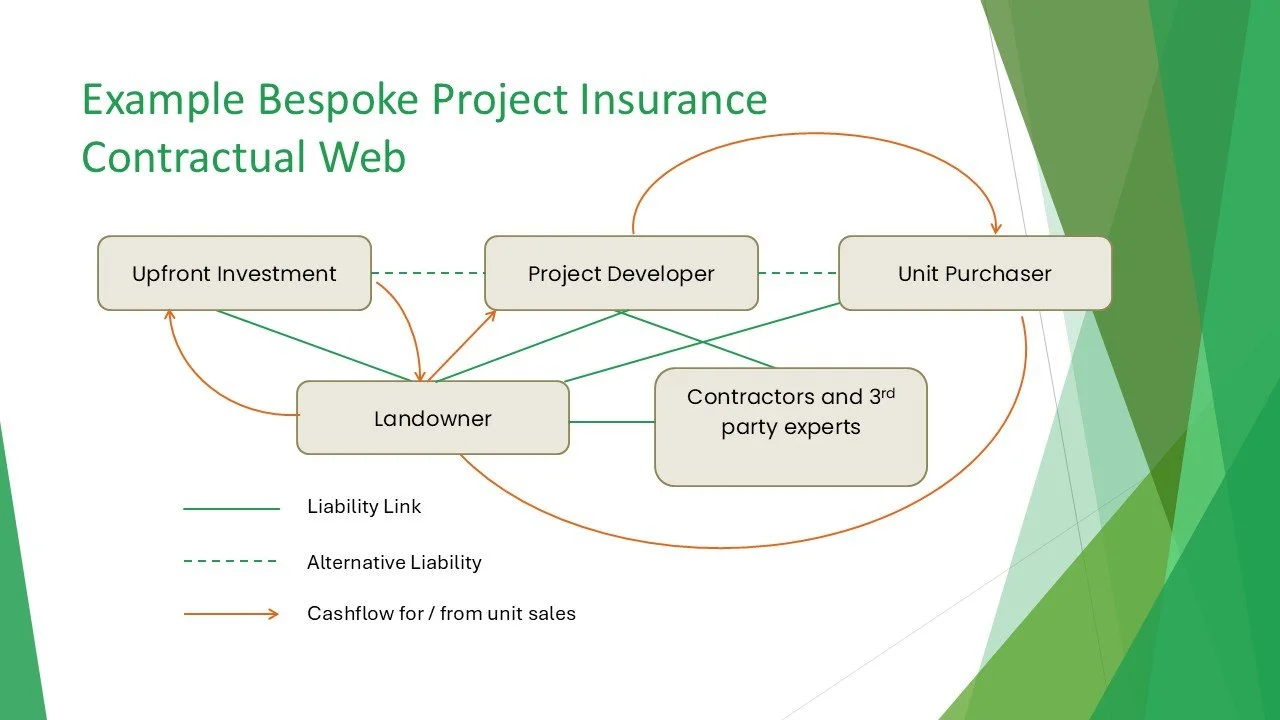

Contractual Complexity and Developer Liability

Nature-based projects operate like any other project (i.e. construction projects), in their contractual web: every contractual or implied link between parties in the project represents a potential route of loss. These risks can arise from contractual liabilities, third-party failures, physical events, or regulatory shifts.

Generally speaking, the developer is the primary bearer of upfront risk. Even when losses occur outside their control, liability remains with them. For example:

Force Majeure: If output falls short (e.g., 50% reduction), the developer is still legally obliged to deliver 100% of contracted units (BNG, carbon credits).

Third-party error: If an ecologist miscalculates baselines, the developer must still ensure delivery.

Loss of Demand: Expected demand does not materialise in line with unit creation, leading to a default on investment return.

In short, broken links in the project chain translate into developer liability, underscoring the need for robust insurance solutions.

Insurance Solutions for Project Developers:

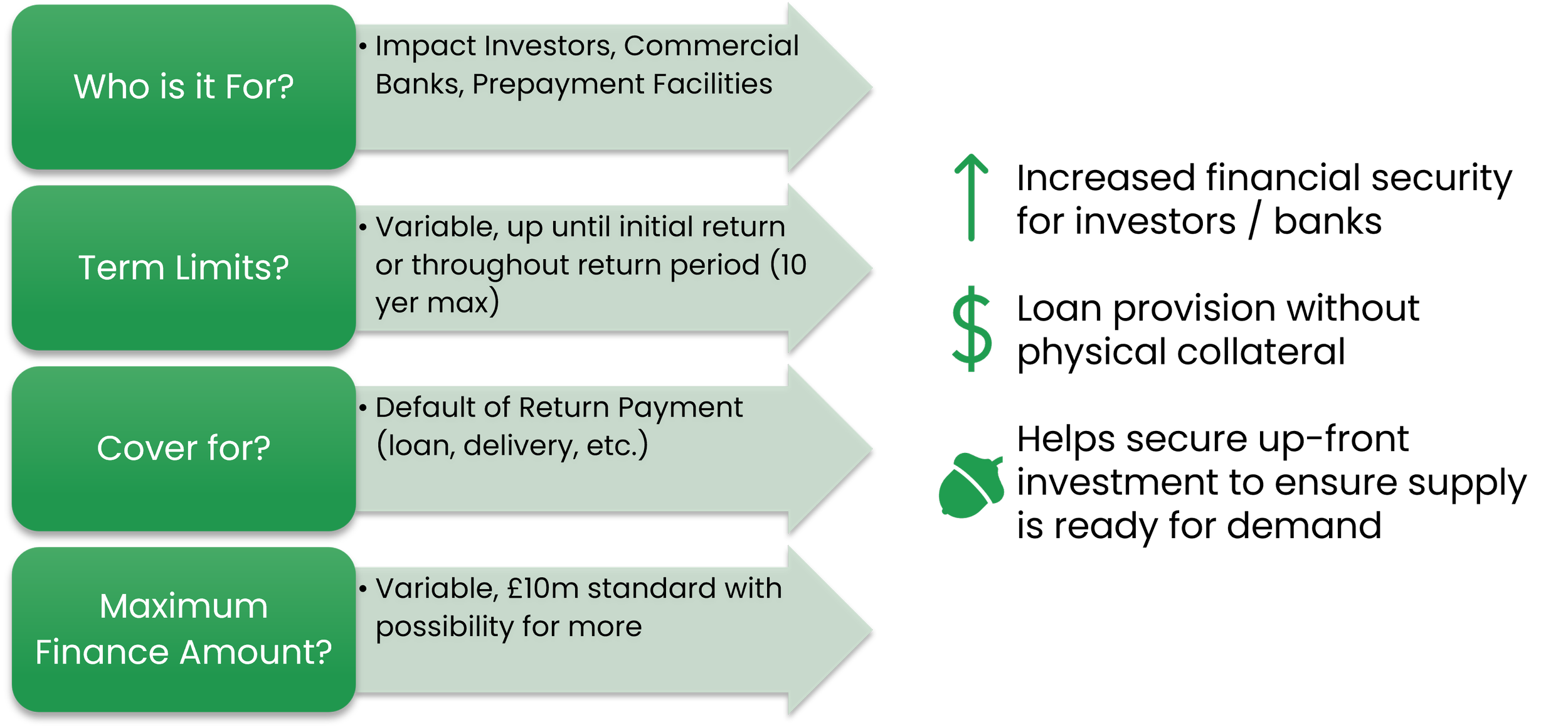

1. Green Finance Guarantees

Comparable to trade credit guarantees, these policies can help protect upfront investment or loans against developer or third-party default.

Coverage: Loan repayment, prepayment for units, project delivery delays.

Use cases: Bonds for upfront funding, habitat bank establishment through commercial loans, equity investment blended financing for large-scale projects.

Structure: Typically short-term (5 years) to cover establishment risk, but longer blended models are possible.

Pricing: Premiums can be built into unit values, offsetting costs for investors.

This provides confidence to financiers and buyers that projects can deliver on commitments. Default can occur for any reason, it is the simple fact of non-payment that triggers the policy (e.g. demand delays, habitat non-establishment, 3rd party failure).

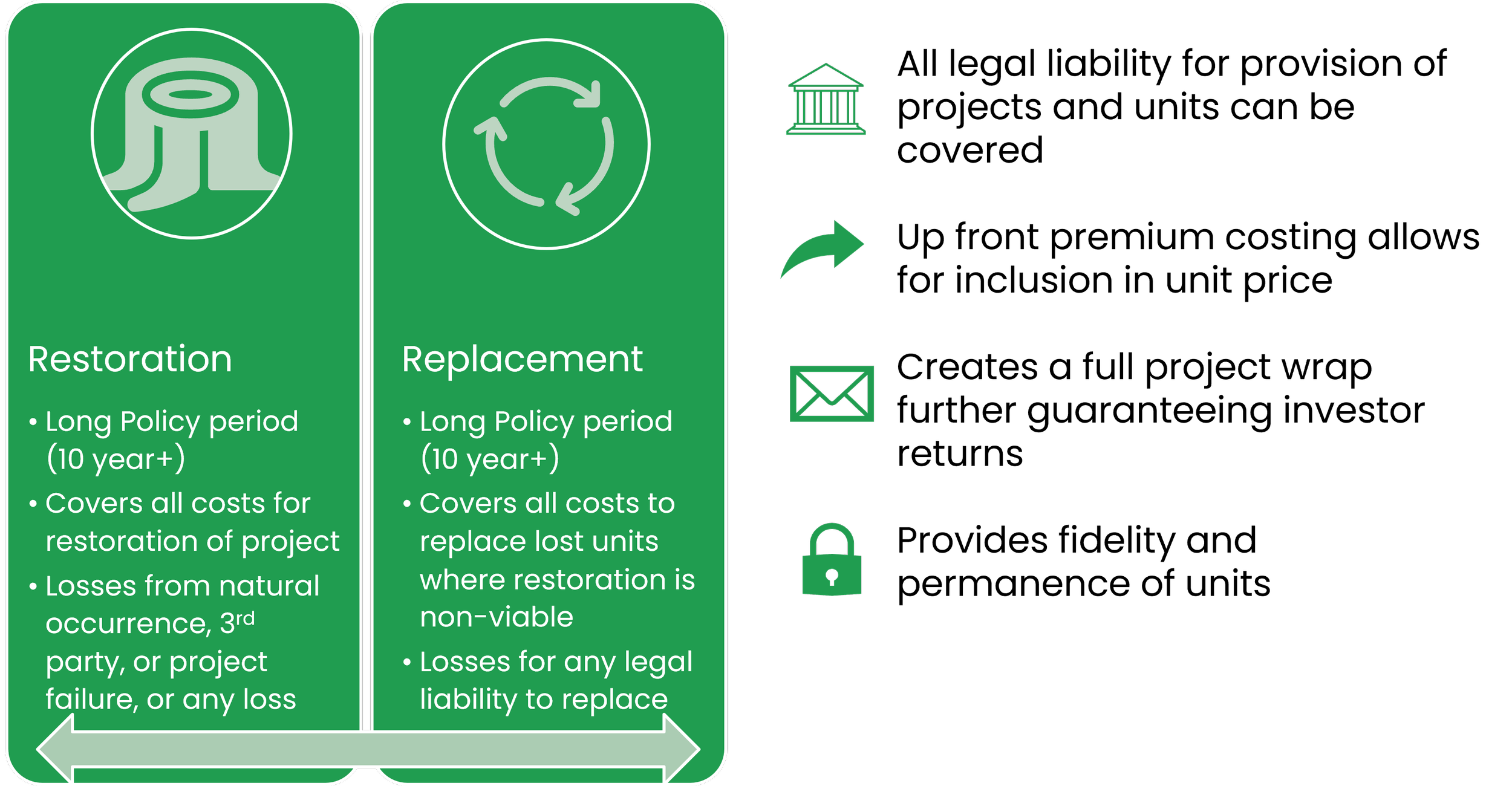

2. “Restore” and “Replace” Wrap-Up Cover

The core insurance types in the blueprint, these insurances can run for the entire project lifecycle, with renewals on long time frames to allow for the establishment and maintenance of the works being undertaken.

Restoration Insurance

Covers restoration works to the land associated with the project if an insurable peril occurs (natural disaster, third-party failure, business interruption, enforcement order).

Functions similar to a construction “works” policy, reimbursing costs to bring the project back to its development plan or expected performance.

Requires regular monitoring, reporting, and verification (MRV), through appointed ecologists, which may align with statutory requirements.

Replacement (or Cancellation) Cover

Provides ultimate liability protection if a site becomes non-viable (e.g., chemical spill, regulatory change, landowner bankruptcy / sale).

Covers costs of purchasing or replacing units to meet contractual or regulatory obligations.

Tailored for natural capital projects and habitat banks, with flexibility to trigger at unit sale or during establishment.

Premiums can be calculated upfront, allowing costs to be built into unit pricing.

Together, these two insurance types ensure continuity of unit delivery through physical and financial solutions, securing the project against even severe disruption throughout its entire lifecycle.

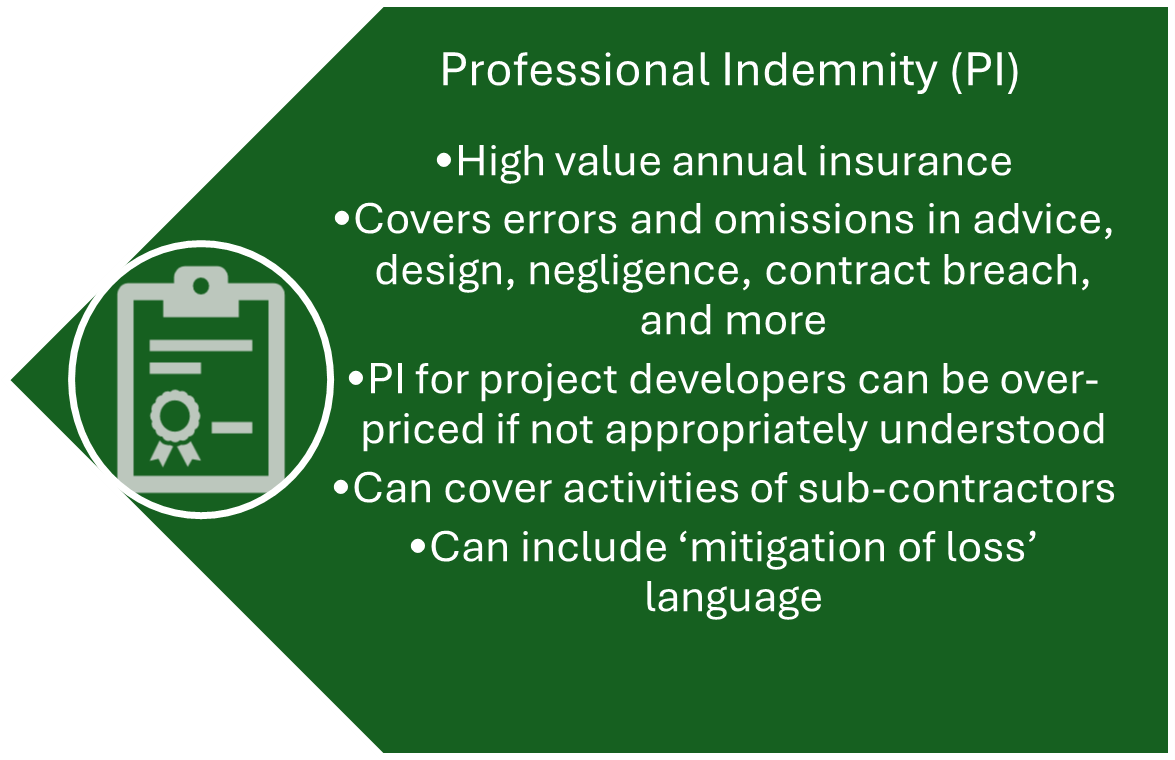

3. Professional Indemnity (PI) and General Insurance

PI insurance (Errors & Omissions) protects against non-malicious errors or omissions in project design and delivery.

Structure: Best placed as an annual policy covering all developer activities, rather than project-specific SPVs (which are costly and limited in market availability).

Scope: Should only cover professional services, dovetailing with restoration/replacement policies.

Contractor-type PI: Extends to subcontractors, allowing developers to claim under their own policy for third-party failures. Insurers then subrogate directly.

Mitigation cover: Some PI policies allow claims for costs incurred to prevent larger losses, a rare but valuable feature.

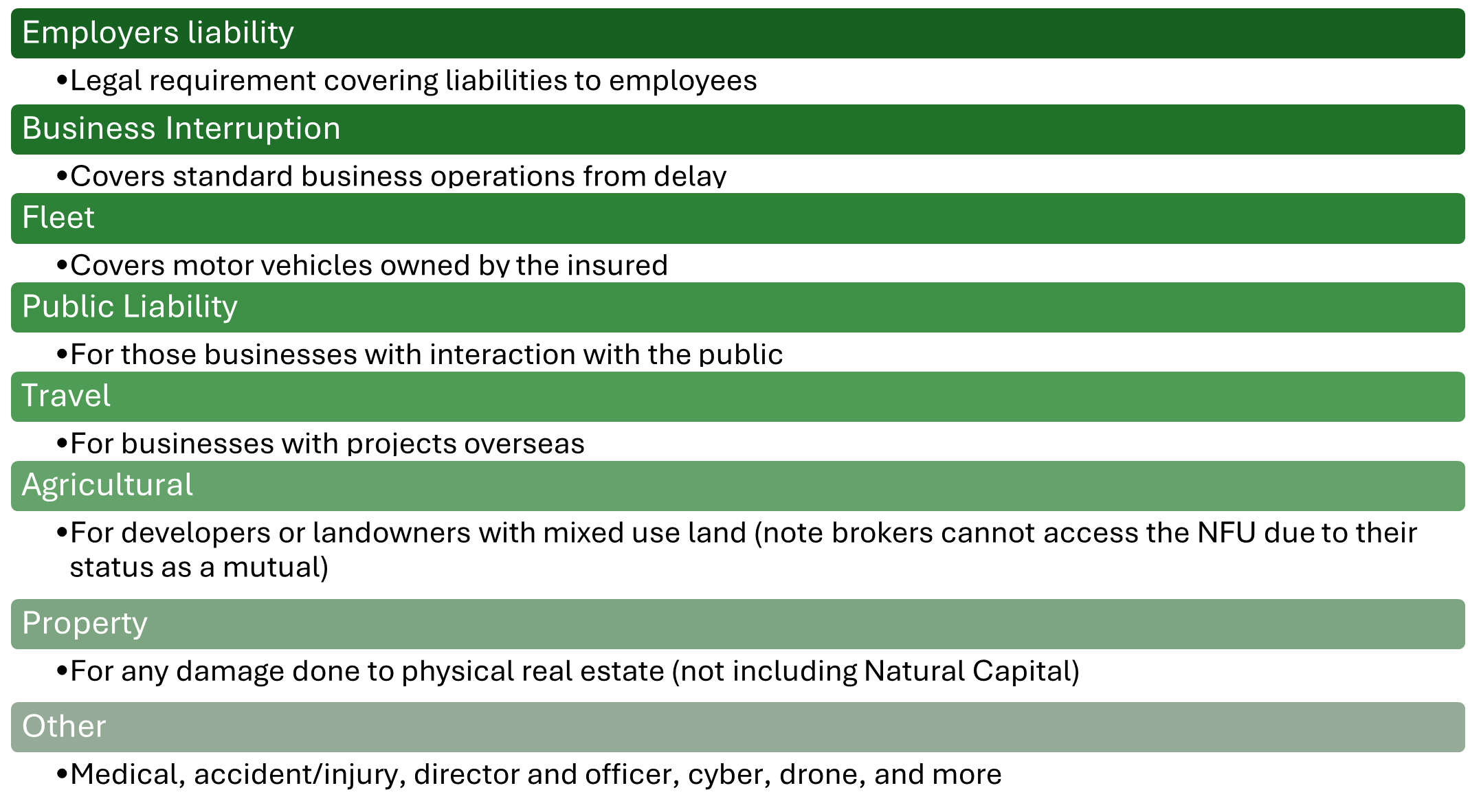

Other standard insurances must be reviewed to avoid overlap and reduce costs through careful layering.

Strategic Takeaways

Developer-centric risk: Liability will generally flow back to, or at least through, the developer, regardless of cause.

Insurance as enabler: Properly structured programmes can transform units from liabilities into assets, increasing buyer and investor confidence.

Integration with finance: Premiums can be priced into unit values, making insurance part of the project’s economic model and providing security for purchasers.

Market evolution: Variations in restoration/replacement policies and long-term agreements (LTAs) are emerging, offering flexibility and cost certainty across a broad spectrum of project types.

The Natural Capital market is nascent but growing - and financing and investment avenues are key to this. Moreover, effective risk mitigation and risk transfer is vital in order to help scale the market at the rate required. Almost no other capital markets operate without full insurance solutions being mandatory - or at least industry standard - and underpinning the security of the tradeable and non-tradeable assets. By providing full wrap up solutions to mitigate the risk of loss to the developer, the finance provider, and the purchaser of the Natural Capital output (in whatever form) we can create a more secure, high fidelity, higher permanence marketplace whereby risk is mitigated along every step of the project lifecycle and financial, natural, and co-beneficial outcomes are closer to being guaranteed.

Our ultimate goal is to bring together the net-positive for all benefits that these projects can bring and underpin them with bespoke insurance solutions to ultimately Secure a Future for Nature.

The above is a summarised version of our full report on insurance for nature regeneration, should you wish to view the full report then please contact us directly.

Disclaimer: The information in this page and the full report is for information purposes only and does not constitute financial, investment, tax or legal advice. Recipients must obtain independent professional advice or engage us directly before acting on any information. No representation or warranty is made as to accuracy or completeness and GaiaSicura Ltd excludes liability to the maximum extent permitted by law.